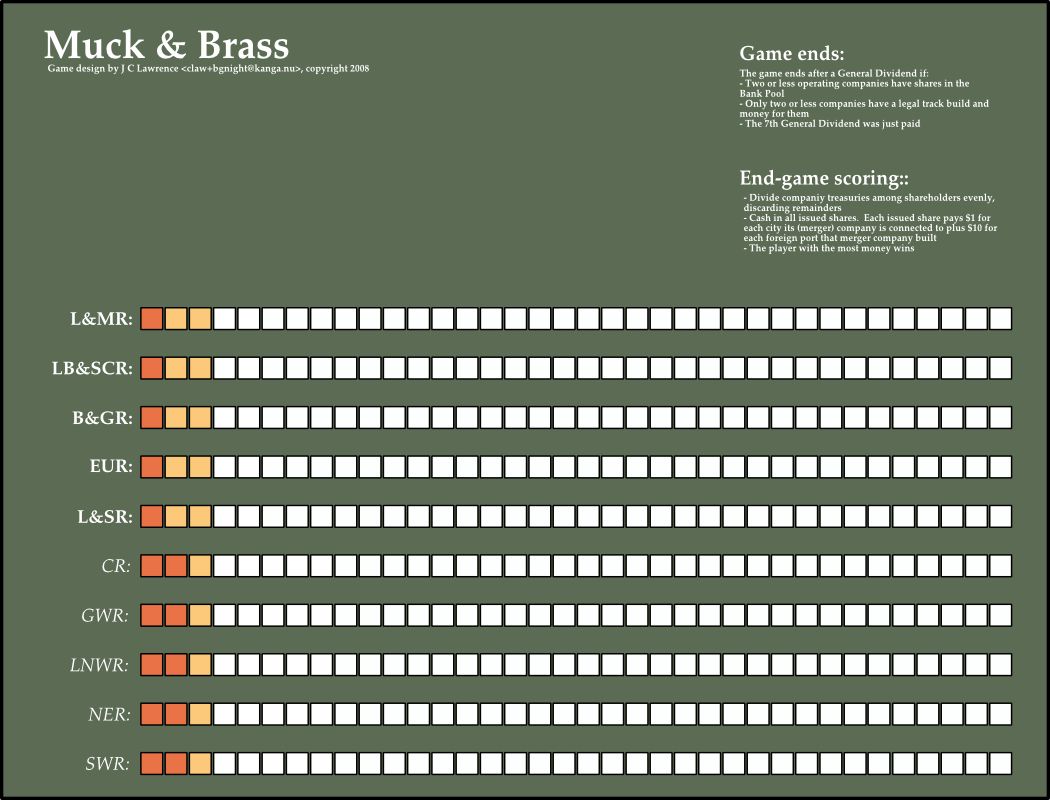

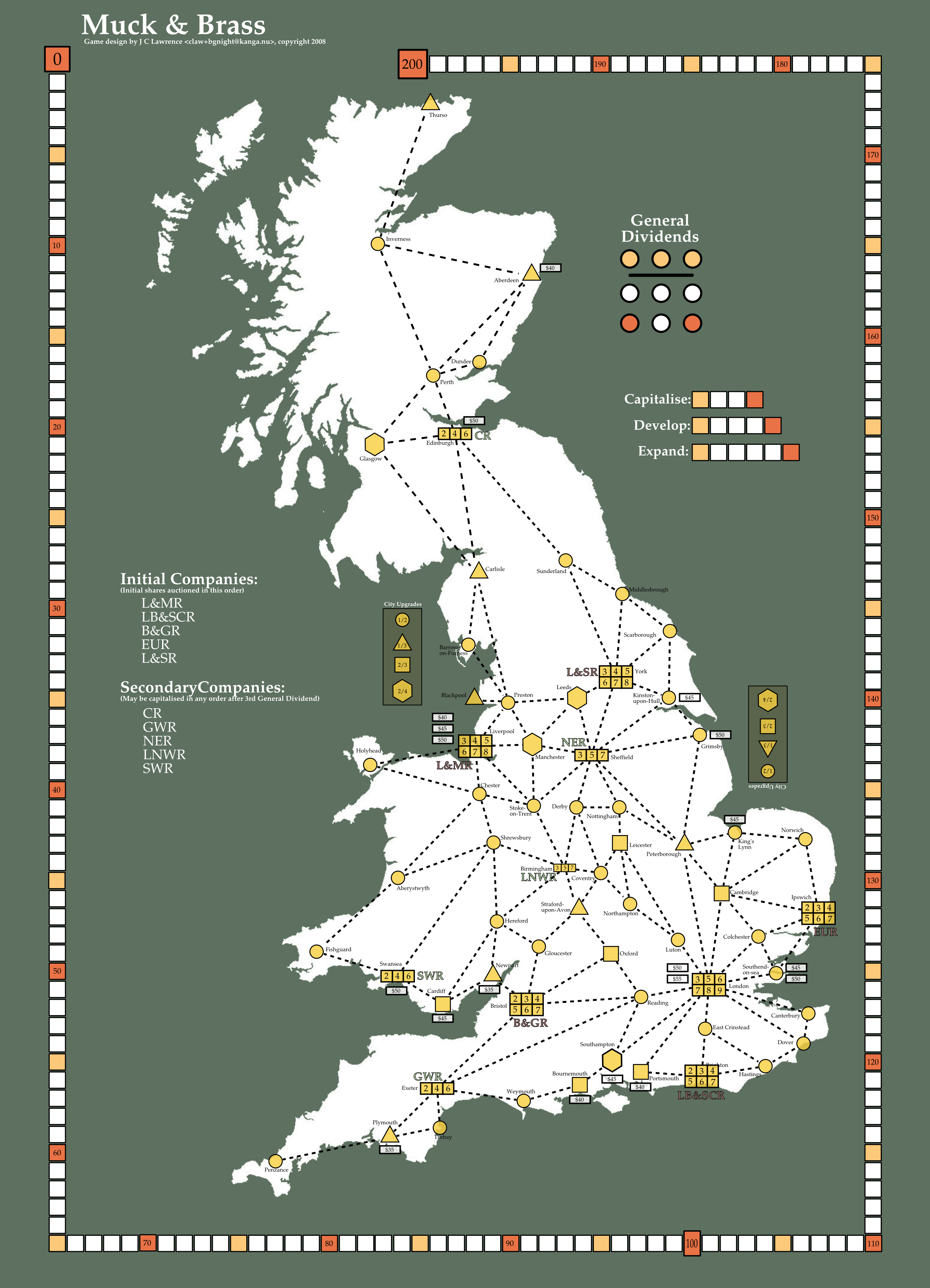

I got talking with Aliza Panitz (BGG: Morganza) last night about the merger model in Muck & Brass and in the process realised that the first or second merger is liable to be too powerful. There are a few primary early merger paths:

- Both northerns via the loop around Sheffield

- One of the southern companies with the L&SR via Peterborough

- One of the two northern companies with the EUR via Peterborough

- Two of the southern companies via Peterborough or any of the other London orbits

The problem is with the mergers with the northern companies and with anything that involves the B&GR from the southerns. If anything in the north merges, and they start the NER, then it will auto-merge, thus generating a second special dividend for those players before the General Dividend. If anything involving the B&GR merges and they start the GWR (which the B&GR has also certainly built to), then the same problem repeats to the south. That’s 3 and a bit of the four early merge cases where a small subset of players get two special dividends in quick succession without any ability for the other players to do anything about it in advance.

That may not be good. Another related problem is the turn ordering which puts the cash richest players first. As soon as the mergers hit they are liable to remain the cash richest as they steamroller as above. To give a quick sense of the problem in concrete terms from this morning’s solo play:

The first expansion after the 3rd General Dividend merged the LB&SRC with the L&SR via Peterborough. The special dividend went to the LB&SRC. The NER was then started, merging the L&SR& (which now contained the LB&SCR) and the L&MR into the NER. A second special dividend was paid to the original LB&SCR share holders. The next expansion merged the B&GR into the EUR and started the GWR which insta-merged into the B&GR for another two special dividends paid to the B&GR share holders. The GWR then merged into the NER via Peterborough and paid a third special dividend to the original B&GR shareholders and a second to the EUR shareholders. They started the CR which was won by a player with so much cash they could simply throw it away on the CR and still win. The next player, who was already low on cash, had no chance at any of the merger shares, built a foreign port as did the last expansion. The game then ended on the fourth General Dividend as there were only two operating companies: GWR & CR.

An obvious partial solution is to require that a merging player pick a secondary company which:

- is not connected by track

or if that’s not possible:

- is not connected to the company which just merged

Such a rule is unpleasantly clunky, if historic and reasonable from a financials market perspective. It pretty much guarantees that the SWR is going to be the first secondary company out with the GWR and LNWR in the next round. The CR is a knife aimed straight at the L&SR and has all the subtlety of the Wabash in Wabash Cannonball. Likewise the The LNWR is a somewhat similar knife aimed at the L&MR and by extension at the B&GR. The SWR conversely lurks between the B&GR and the L&MR and can’t insta-merge in one build like the CR and LNWR can, but it potentially controls many foreign ports and is thus interesting for that reason alone. The NER is just a pig – whenever it starts it will isnta-merge into whatever the current shape of the L&MR/L&SR pair is. The GWR is a similar inst-merge into whatever the B&GR is then.

At least there’s now some subtlety to the mergers with the ugly delay rule.

Sigh.

Another potential model struck this morning:

- Scrap all the current merger rules

- Starting after the third General Dividend players may start capitalising the secondary companies. As soon as a share sells (two? three?) they may start operating.

- Should a secondary company build into another operating companies home station (using its own track) the other company is absorbed, shares trade up etc and there’s a special dividend for the secondary company

ObNote: This model may unduely protect the LB&SCR and EUR and unduly weaken the NER. It may also require adjusting the rule-of-three track building rules.