Quite a few changes this week.

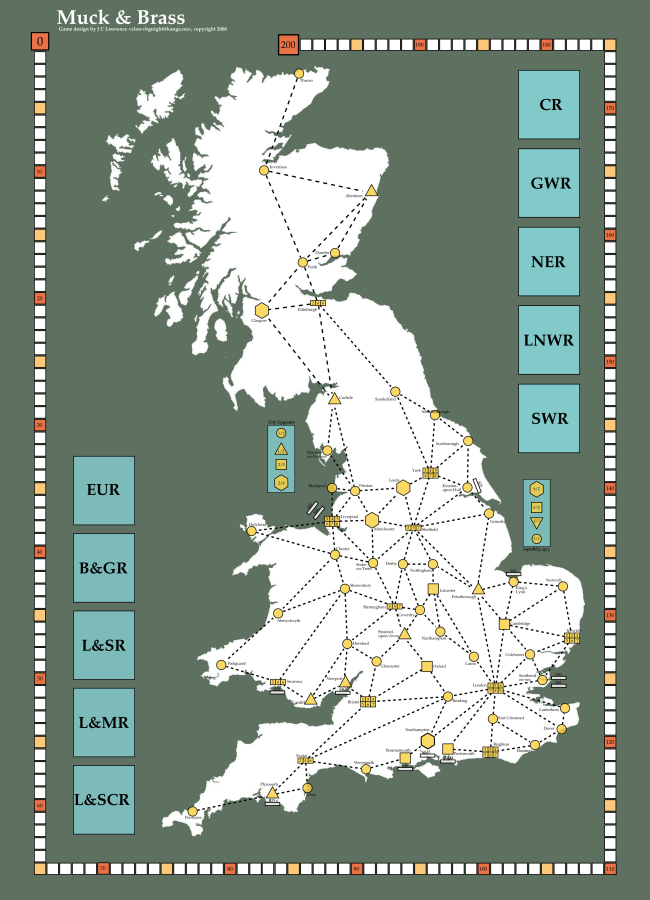

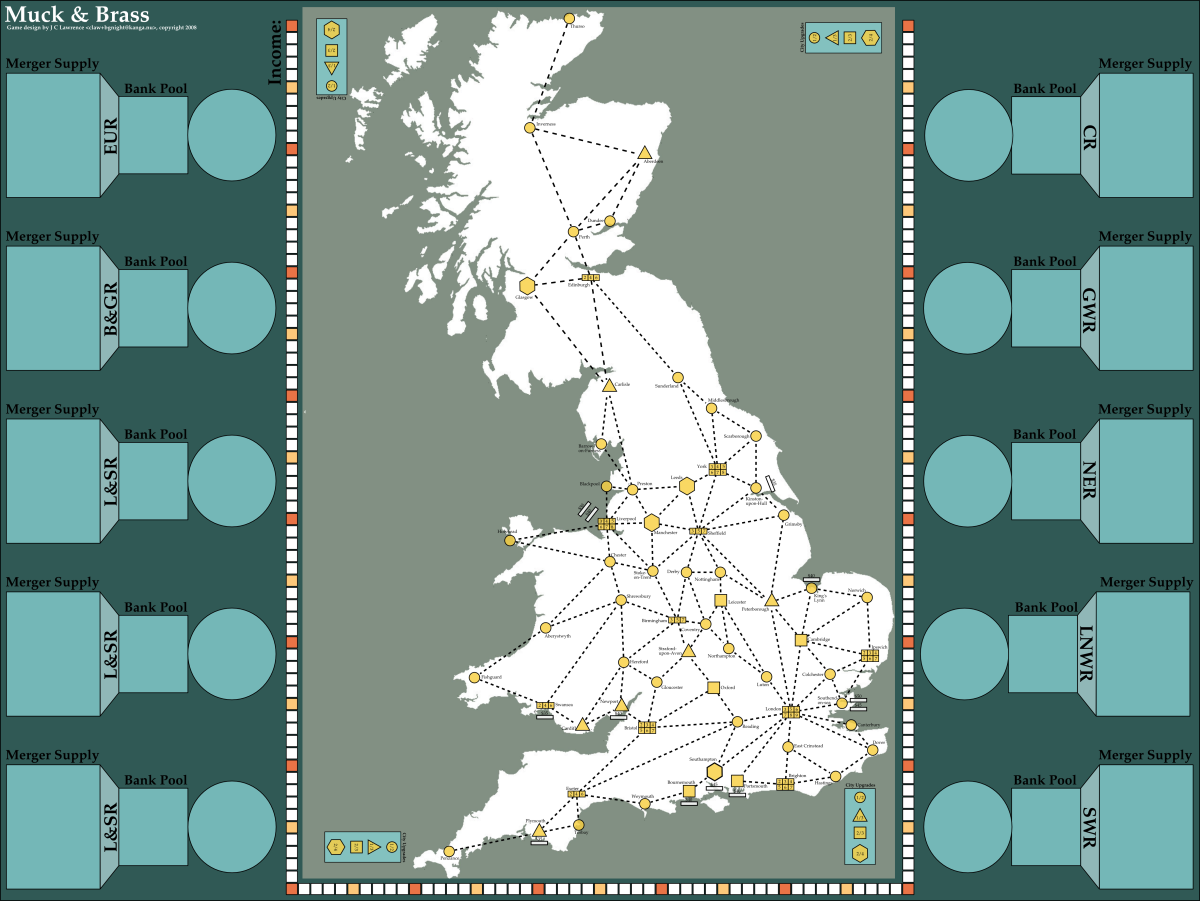

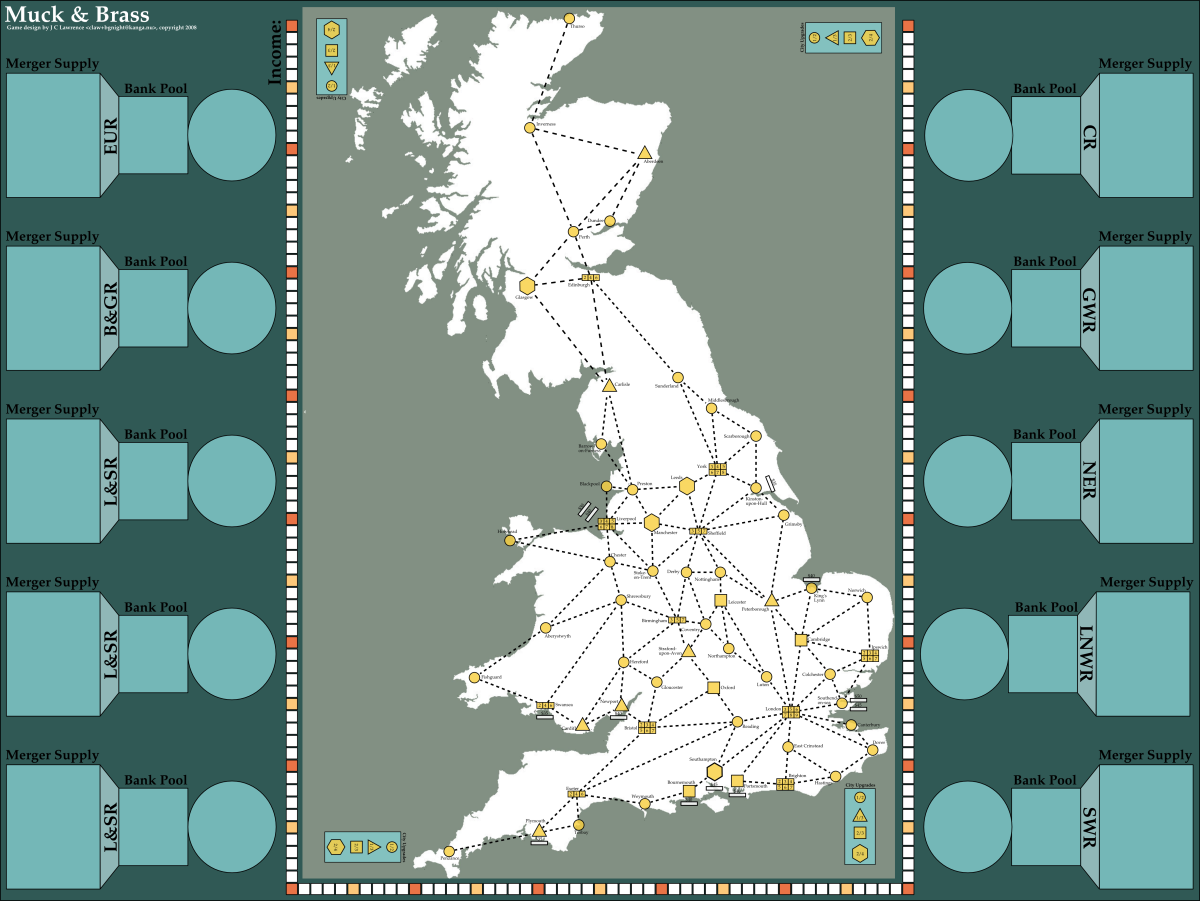

I spent a few hours digging through the early history of the English railways from around 1830 onward and picked a more representative set of companies for the areas I’ll be putting them in. I also ordered them by starting date so that the initial companies did in fact start earlier as railway companies and the merger companies did in fact start later and heavily focused on mergers (eg GWR, LNWR, NER etc). There are a large number of goofs in home stations, but none I hope egregiously large (eg the GWR starting in Exeter?).

The current initial companies are:

- Eastern Union Railway (EUR, started 1846, Ipswich)

- Bristol & Gloucester Railway (B&GR, started 1840, Bristol)

- Leeds & Selby Railway (L&SR, started 1830, York)

- Liverpool & Manchester Railway (L&MR, started 1830, Liverpool)

- London Brighton & South Coast Railway (LB&SCR, started 1846, Brighton)

Merger companies:

- Caledonian Railway (CR, started 1845, Edinburgh)

- Great Western Railway (GWR, started 1838, Exeter)

- North Eastern Railway (NER, started 1847, Sheffield)

- London & North West Railway (LNWR, started 1846, Birmingham)

- South Wales Railway (SWR, started 1845, Swansea)

I’ve also had a first pass at allocating share counts for the initial and merger companies. Total gut sense with initial companies running from 3-5 shares and merger companies running 8-10 shares. I’m clearly going to have to play with those numbers.

The rules are looking pretty clean now. Not final but at least playable without instant gamer-pattern baldness.

A remaining problem is what order to auction the initial company shares in? It is tempting to do them in historical opening order which would be: L&MR, L&SR, B&GR, EUR, and finally LB&SCR. I’m not so happy about the very ordered progression from north-to-south that sequence represents on the map – despite the fact that the industrial furnaces of the midlands did actually drive the industrial and railway revolution in England. My sense is that the auction ordering should pose immediate spending challenges with early risks made in spite of later temptations. The three companies near London are obviously attractive – London develops beautifully and there are many fine ports to the south (the white bars) which offer Special Dividends – but having them come together as a group seems…wrong/odd. Likewise for the L&MR and L&SR with the wonders of Sheffield, Leeds and Manchester right next door. Urk.

Proposal:

- LB&SCR

- L&SR

- EUR

- B&GR

- L&MR

Of course that’s all higgledy-piggledy for historical dates, but it may work better. I’ll have to sleep on it.

Over the last couple days I moved the map from yEd over to Inkscape and into SVG format. Unfortunately this required a nearly from-scratch redraw as I lost patience writing the script to post-process yEd’s concept of what it should produce for SVG elements versus what I thought I wanted. Fortunately for such a simple graph this did not take long. A few colours here and there, an income track, yada yada and voial!

Note to self: Must remember to put numbers on the income track.