Tentative zetetic

Below is a possible introduction section for the rules. Some of the stated goals, like the duration, may be ambitious, but that’s the nature of good goals:

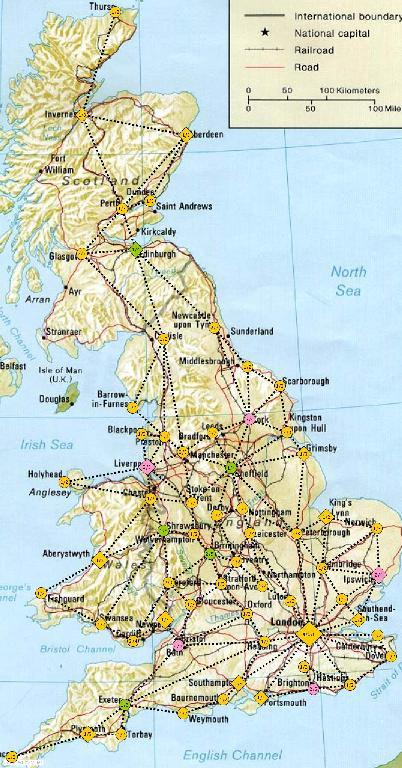

After the birthplace of the steam engine, railway development in England was a rocky and tortuous affair. Bankruptcies were common. Struggling railway companies merged and then merged again, acquired other companies and became not-so-vast agglomerates. In Muck & Brass players will invest in railway companies and then attempt to leverage their investments for profit. Railway companies will start, grow and then merge into each other as yet more companies pop up to join the frenzy of growth and mergers.

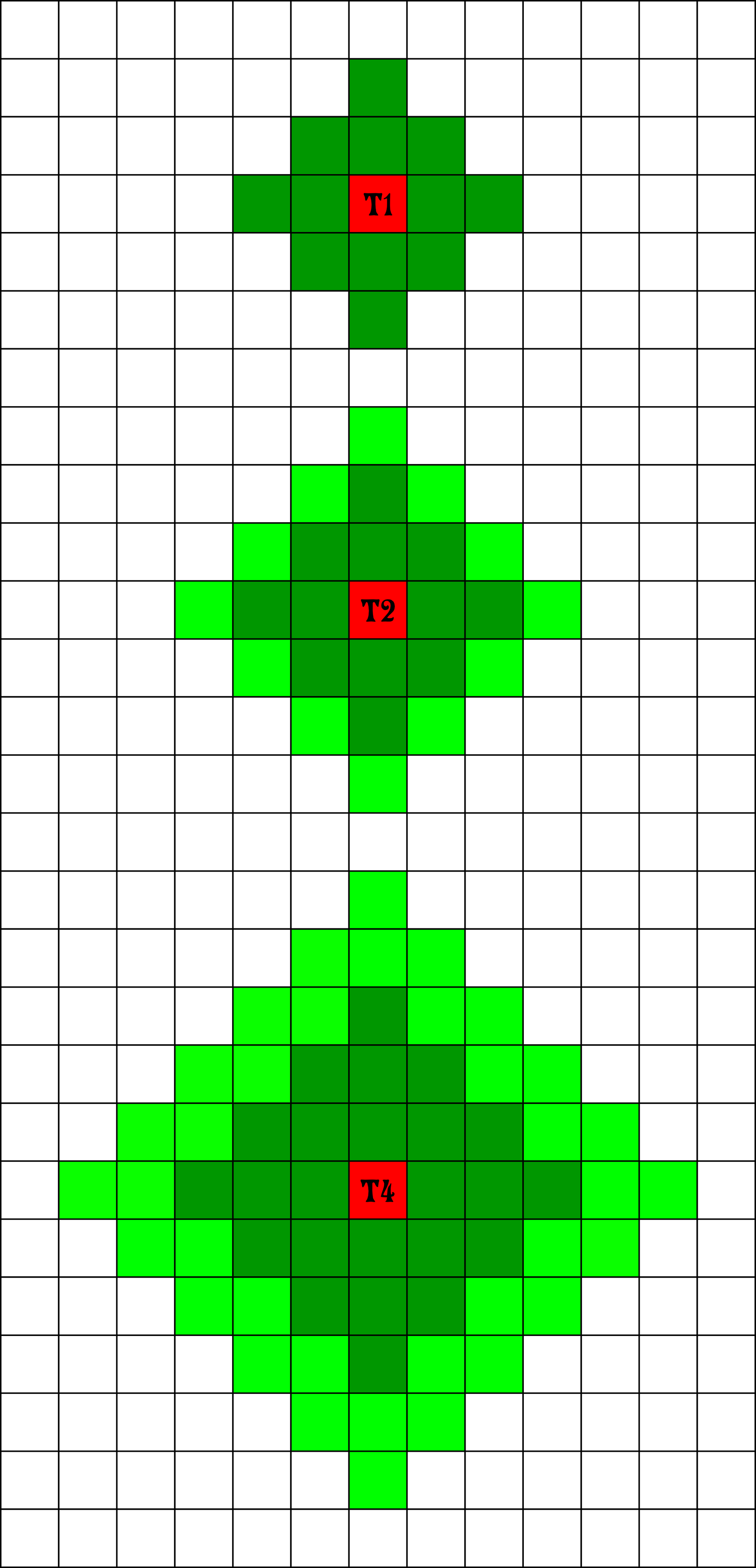

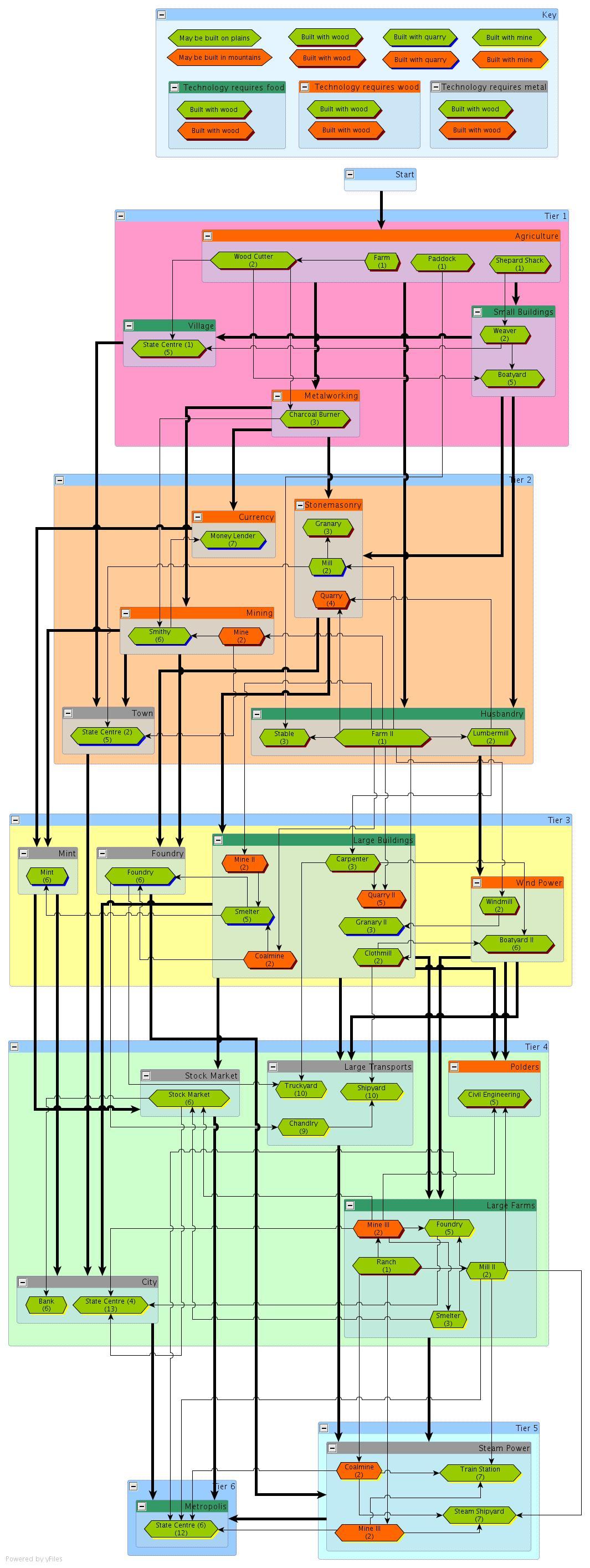

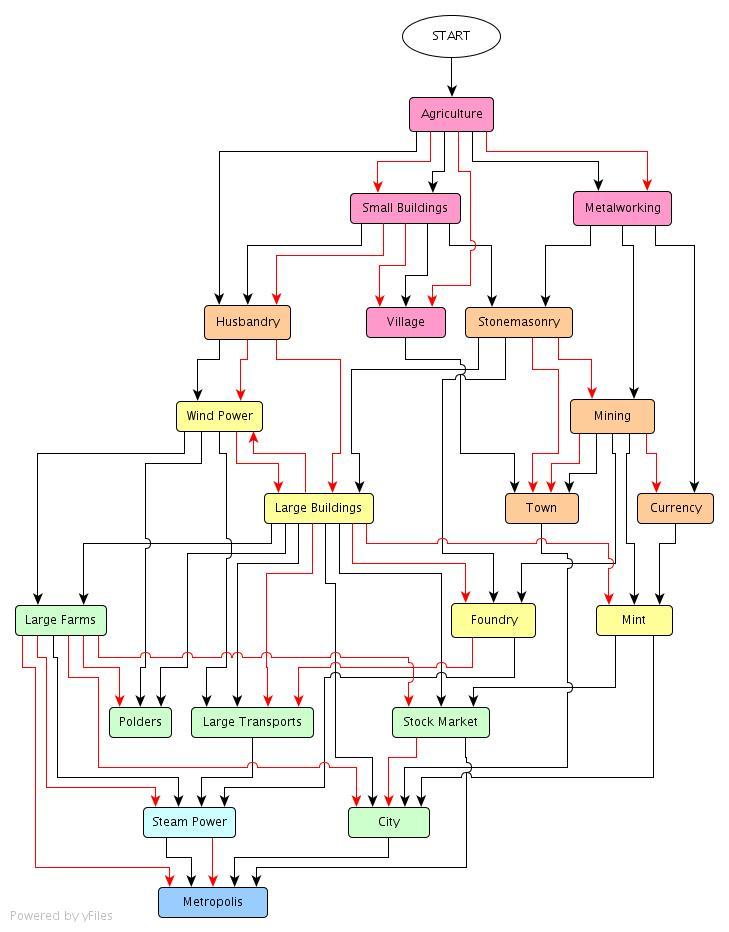

During the course of the game players will buy and sell dividend-paying shares at auction, build track to increase the income of the companies they own shares in, and develop the industrial base of cities the companies serve to further increase their income. After a period of heady growth companies will begin to merge, creating both ever larger income vehicles and prompting new companies to join the growth and merger fray.

By carefully controlling and timing the purchase and sale of shares, the railway networks their companies build, the development of the cities they connect and the mergers of the companies, players may leverage their investments for great profit.

The game ends after one or more of:

-

the seventh (7th) general dividend

-

only two operating companies have unsold shares

-

only two operating companies have a legal track build and can afford it

The player with the highest net worth at the end of the game wins.

Muck & Brass supports 3 through 6 players, is particularly recommended for 4 or 5 players and plays in around 90 minutes.